GST collection rises 12% to Rs 1.57 lakh crore in May

During May, 2023, revenue from import of goods was 12% higher and the revenues from domestic transactions including import of services are 11% higher than the revenues from these sources during the same month last year.

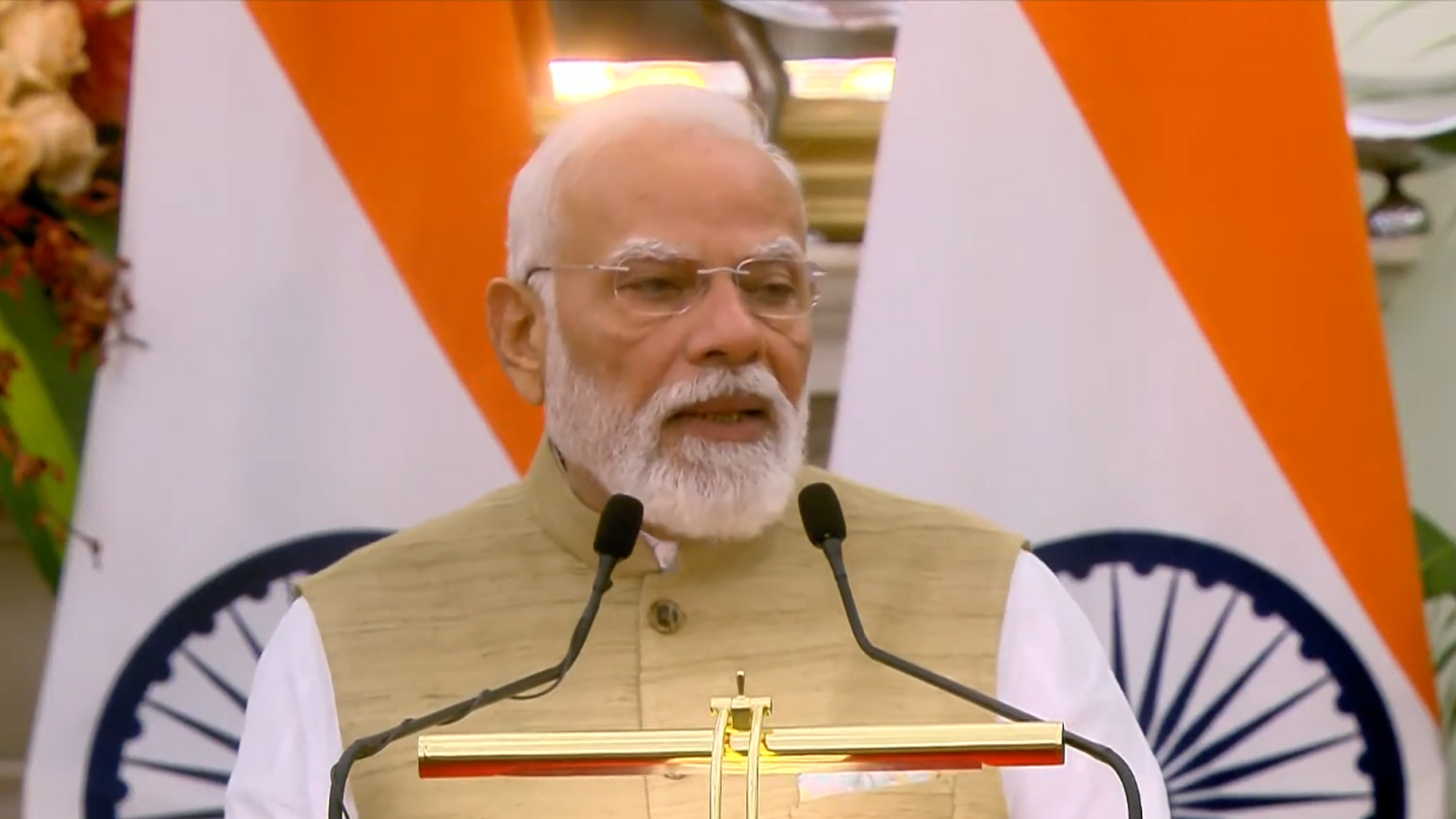

GST is consistently proving to be a path-breaking economic reform for new India. GST collection is continuously growing at good pace. The revenues for the month of May 2023 are 12% higher than the GST revenues in the same month last year. The gross Good & Services Tax (GST) revenue collected in the month of May, 2023 is Rs. 1,57,090 crore. It comprises Rs. 28,411 crore CGST, Rs. 35,828 crore SGST, Rs. 81,363 crore IGST including Rs. 41,772 crore collected on import of goods and Rs. 11,489 crore cess including Rs. 1,057 crore collected on import of goods.

The government has settled Rs. 35,369 crore to CGST and Rs. 29,769 crore to SGST from IGST. The total revenue of the Centre and the states in the month of May 2023 after regular settlement is Rs. 63,780 crore for CGST and Rs. 65,597 crore for the SGST.

During May, 2023, revenue from import of goods was 12% higher and the revenues from domestic transactions including import of services are 11% higher than the revenues from these sources during the same month last year.

After the implementation of the GST, India turned into one market with uniform tax on supplies of goods and services. In last six years, the GST ensured compliance simplification with uniform processes across the country.

First proposed by the Atal Bihari Vajpayee-led NDA government in 2000, the GST has eliminated human interface from the indirect taxation system, enhanced transparency and fulfilled the dream of One Nation, One Tax.